For most aspiring business owners, the desire to own a business comes down to three motivations: being your own boss, building something / having an impact, and financial upside.

Most of these benefits can be achieved without owning a business. A freelancer has similar or more flexibility than a business owner and charities have a tremendous positive impact on the community.

The financial upside however is difficult to replicate. Starting without significant capital, the most realistic chance for a 7-figure pay day is to own and sell a company. To be fair, there are other options like receiving equity in a start-up, sharing profits in investment funds and sure, even winning the lottery. However, all those options fall short because of the lower likelihood (lottery, start-up) or because they require decades of experience (receiving profits from investments funds).

If you have decided to swing for the fences and become a business owner, the question becomes whether you should start a business or buy one.

Creating a scalable business model vs. buying one

Aspiring business owners often overromanticize the idea of starting a business. They would be able to set everything up properly from the start and do it their way. No need to transform the operations of an established business, just built a scalable business right from the start.

While setting up a business in that way might feel fulfilling, it does little to solve the actual challenge of creating a working business model and generating revenue. Unless you are starting a business that is closely related to your current expertise (a lawyer starting his own law firm), you are likely going to have neither a good product-market fit nor a good business model initially. And once you find it, convincing customer to buy your unproven product / service is difficult at first.

The next issue after finding a working business model is making it scalable. Many business owners fail at this stage, because their business model depends uniquely on them - only they are licensed to provide the service, are able to sell the product, etc.

Buying a business lets aspiring owners bypass all those steps and jump into something that is working, maybe not perfectly, but working. If you start a company, you have to be convinced that your product or service is a vastly superior business model with a much larger upside to justify the risk of not buying something that already works and working from there.

How fast can you scale?

So let’s assume you have found a niche where your product or service is way better and the upside is larger than buying an existing companies. The next question is how quickly can you actually grow? A billion dollars is great, but in a billion years, not so much.

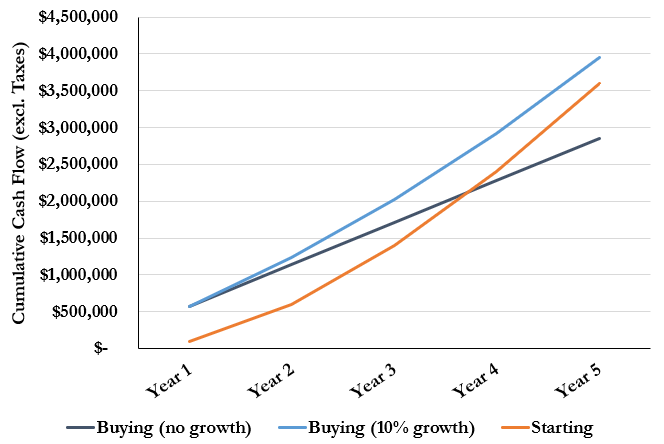

The relatively low purchase multiples for small businesses (~3.0x - 4.5x EBITDA) mean that aspiring owners would have to scale a new business rapidly to achieve the same upside. A 3.5x EBITDA acquisition multiple represents a ~4 year payback term (assuming 21% tax rates) if the EBITDA of the business stays flat. So if you use every dollar the business generates to repay the acquisition loan, you will fully own the business in 5 years. In other words, the questions of buying vs starting can be reframed as “can you scale a new business faster than you could repay the loan for an acquired business"?”.

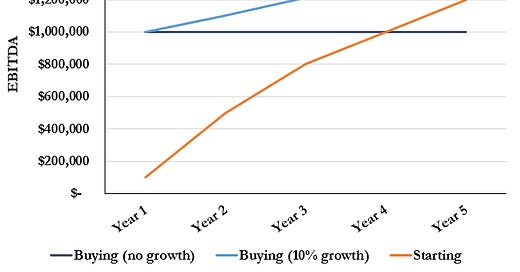

The example below compares 3 scenarios for $1mm EBITDA companies. The buying scenarios assume $1mm of EBITDA at acquisition (one without growth, one with 10% growth) and the starting scenario assumes the business reaches $1mm of EBITDA in year 4.

Obviously, in the buying scenarios the owner would have to make loan payments (~$430k assuming a 3.5x purchase multiple and 90% debt financing). Looking at the cumulative cash the businesses generates after debt service in each scenario (excl. taxes), it takes the starting scenario 4 years to catch up to the no-growth buying scenario and it still hasn’t caught up to the 10%-growth buying scenario after 5 years.

By buying a company, the owner would have 4+ years to transform the operations and still be ahead of starting a company and growing it to $1mm EBITDA over the same time period (an impressive achievement in its own right).

The scenarios obviously exclude the proceeds from selling the business, but the assumption is that you would be able to transform the acquired business to have the same growth path going forward as the start-up business, so they would have similar exits.

What is your personality (Entrepreneur vs Operator)?

Whenever I talked to friends about our long term goals, we would always end at the same spot: We’d all start our own companies eventually. But almost none of us had had a good enough idea yet. It became clear that the issue wasn’t the quality of our ideas, but our personalities.

I think of business owners as being either entrepreneurs or operators. The main difference is that entrepreneurs start with an idea of a product or service that should exist and work backwards while operators look at existing products and services and look for incremental improvement. Entrepreneurs have a high failure tolerance, a why-not-us attitude, a long-term view and like winning. Operators have a low failure tolerance, are cognizant of competition, are focused on the present and hate losing.

That doesn’t mean that operators never start businesses, but they tend to start businesses in their industry with years of experience looking for incremental improvement (think the HVAC tech with 20 years of experience starting his own shop) compared to entrepreneurs that try to come up with an entirely new product or service.

My friends and I all fell more in line with the operator mindset. To me starting a certain business would sound like competing with well-capitalized players, long sales cycles, lack of a unique selling point and low probability of winning, while someone with an entrepreneur personality would hear slow incumbents, high customer lifetime value, potential to develop a unique product and high long-term potential.

Unless you have an entrepreneur personality, no idea will ever be good enough to overcome the long uncertainty, slow ramp and low success chances of starting a business.

Conclusion

The buying vs starting decision depends mostly on personal preferences. But for folks like me to whom no idea was ever good enough and the years of uncertainty whether your business model really works or not were an issue I wasn’t going to get past, buying a proven, successful model gave me a chance to swing for the fences, in a safer way.

Distinction between entrepreneurs and operators is just perfect. I've been thinking about it for years, but for the first time somebody put it in such a clear and concise way that it really resonated with me.