The Definitive Guide To Understanding The Step-Up and Self-Funded Investor Terms

Why your 1.5x Step Up deal probably won't get much traction

The deal terms for self-funded search deals are unique among private equity deals and can be somewhat hard to get an intuitive understanding for. I’ve written previously about the common reaction of investors wondering why in the world a first time operator would get 80% carry (the share of the deal profits the sponsor gets) when funds with decades of track record get 20%, maybe 25% if they knock it out of the park.

Similarly, there seems to be a similar amount of confusion around structuring deal terms for investors in self-funded search deals and the step-up concept. So today, let’s talk about why the step-up concept is ideal to compare self-funded deals to private equity deals, why I believe a 2.0x step-up should be market standard, and how to use that structure to come up with the terms you offer investors.

Two Competing Investment Opportunities

Here’s our hypothetical scenario. You have $400k and two investment opportunities:

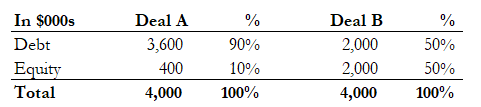

Deal A is self-funded search deal buying a company with $1mm of EBITDA for $4mm. The searcher is raising $400k of equity and offering 20% ownership in the company.

Deal B is a private equity deal buying an identical company ($1mm EBITDA, $4mm purchase price). The sponsor is raising $2mm of equity and charging 20% carry.

Assuming both companies perform identical (same financial performance, exit price, etc.), in which scenario are you better off as the investor?

Let’s start out by comparing the equity ownership your $400k investment gets you in each scenario. Deal A is obvious. Your $400k gets you 20% ownership in the company. For Deal B, the investors technically own 100% of the company, but since the sponsor is getting 20% carry, they really own 80% of the economics of the equity. Your $400k is 20% of the total equity investment of $2mm, so your ownership is 16% (20% of 80%).

So despite the self-funded searcher receiving 80% carry and the private equity fund receiving 20% carry, the investors get more equity ownership for their $400k investment (10% of purchase price) in the self-funded deal. That’s exactly what the Step Up concept helps illustrate.

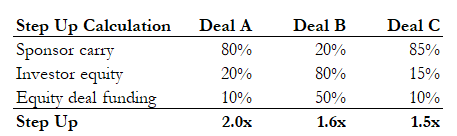

The calculation for the Step Up is the following: Investor ownership % divided by percentage of purchase price funded by the investor. So in Deal A, investors are funding 10% of the deal and getting 20% ownership, resulting in a 2.0x Step Up. By dividing by the percentage of purchase price funded, the step up captures the benefit of leverage. For example, a deal funded entirely by equity with no carry would have a step up of 1.0x (investors own 100% and funded 100%).

We already knew from looking at the % of equity we were getting in each deal that we were getting more upside in Deal A than Deal B. But the Step Up offers a broader benefit. While we can compare Deal A to Deal B based on the amount of equity our investment gets us, we don’t know whether or not the deal itself is good. That’s where the Step Up shines.

Step Up is a relative metric that shows capital structure adjusted ownership

Now let’s add a different deal into the mix (Deal C). Self-funded deal, $2mm EBITDA, $8mm purchase price. Raising $800k of equity and offering 15% ownership. Our $400k equity investment gets us 7.5% ownership. Way less than Deal A or Deal B. But comparing the % ownership directly isn’t fair. The Company is double the size.

Since the Step Up is a relative number, that the actual amounts are normalized and we can compare the deals. In the case of Deal C, investors get 15% ownership for funding 10% of the deal, which is a 1.5x Step Up - worse than both Deal A and Deal B.

So how do we know what good and what a bad step up is for a self-funded search deal? Let’s start with private equity deals and public companies as a comparison.

Public companies tend to have lower leverage, proven operators and large businesses. The Step Up is usually in the 1.0x - 1.5x range (1.0x for no debt, 1.5x for some higher levered companies).

Private equity deals use some leverage, have strong operators and buy medium to large size businesses. The Step Up is usually in the 1.5x - 2.0x range. The more leverage, the higher the Step Up.

So that brings us to self funded deals. The deals use 80-90% leverage, for a first time operator in a small business. In order to invest in that risk profile relative to the alternatives, I would argue you need a significant premium. That’s why I don’t really touch deals with a Step Up below 2.0x. The average across all deals that I have invested in over the past 2 years is 2.4x.

But what about other deal factors like purchase price, the business, the operator?

I have previously written about how I factor in the purchase price in my adjusted step up calculation where I calculate the step up based on where I think the business should be trading rather than the purchase price.

Adjusted Step Up for Value Buys and Over Payments: For deals that are significantly above or below market value, instead of having very high or low Enterprise Value Creations, the better way is to adjust the Step Up.

For example, say a searcher has a business under LOI for $2mm that should really trade for $4mm, and the searcher is offering 15% common equity for 10% of the purchase price ($200k at a 1.5x step up). You’re really putting in $200k into a $4mm business (5% of purchase price) and getting 15% equity, so the adjusted Step Up is 3.0x and you would use the $4mm as the purchase price for the Enterprise Value Creation.

On the flip side, if a searcher has a business under LOI for $6mm and is offering 25% equity for $600k (10% of purchase price - 2.5x step up), but the business actual value is $3mm. You’re actually putting in 20% of the market value ($600k on $3mm) while getting 25% of the common equity, so your adjusted Step Up is 1.25x and you would use the $3mm as the purchase price for Enterprise Value Creation.

Obviously other factors such as the business and the operator key criteria regarding whether or not to invest. However, the point of evaluating the adjusted step up is to ensure that as an investor, I get appropriate economics in the deal for the risk that I am taking.

There is no benefit from investing in the best deal with the best operator if I don’t make any money if the deal goes well. A 2.0x Step Up is a minimum threshold to ensure appropriate economics and then we can assess whether we like the business and the searcher.

But what about the difference in interest, amortization, etc. in a self funded deal vs. private equity?

I will admit the first time I started playing around with Step Up calculations, I had a similar feeling. Like sure on paper this looks good, but you are leaving a lot of important things out. For example, the self funded deal has a much larger loan amount, so the interest is way higher. Doesn’t that change things?

The answer is that those are all rounding errors compared to changes in the Step Up. Here’s the example from above buy with the Deal B (the private equity deal) also having a 2.0x step up. Below are all the assumptions, same financial performance, repayment in year 3, exit at the end of year 5, just different capital structures.

The IRR, MOIC and even $ profit are pretty much exactly the same.

Conclusion

The Step Up concept is an incredible tool to compare deals with different capital structures and operator incentives. Searchers should use the Step Up to determine how much equity they need to offer to investors.

If you offer a 1.5x Step Up, you are essentially saying that you are better operator than private equity funds and your business is better than the typical private equity deal (it’s not). While there is certainly growing investors interest in search deals, none of the veteran investors that I know will do deals at a 1.5x Step Up. It’s not a good risk adjusted investment. Do yourself a favor, offer the normal 2.0x. You’ll get more interest, get to pick your investors, and having 85% vs 80% equity won’t make a difference when you hit it big, but not getting your deal done will.

Lastly, investors don’t care that much about the preferred return. It’s only purpose is to create the right incentives to pay back the preferred return before the debt. So just look at the most expensive debt you have and add 1-2% (currently it’s typically 10-13%).

So there you go. No need to spend ours modeling investor returns. A 2.0x step up and a 12% preferred rate will get your deal funded with good investors in 1-2 weeks (assuming the deal is decent).