The Emotional Roller Coaster of First Year SMB Operations

The right of passage to becoming an SBM operator

We’re back! It has been a minute since the last post, so first off all welcome to all the new subscribers. As a quick refresher, my partner and I bought an artificial turf installation business in February 2022 after quitting our PE jobs to run a self-funded search.

I wrote all the articles posted on this blog so far in the 2-3 weeks leading up to closing, when our day mostly consisted of waiting on the banks, lawyers and accountants, so I would remember everything we had learned in the process and pay it forward to the next generation of searchers.

Once in the operating seat, it became hard to justify the hours of writing in depth posts when I could spend 24 hours a day working on the business. I felt (and still feel) a real duty to dedicate all my brain power to the business, which is why there haven’t been new posts in a while. However, almost one year in, we now firmly have our hands around the business allowing me to post more regularly (shooting for the first Saturday of every month).

The Emotional Roller Coaster of First Year SMB Operations

I typically write about the analytical side of searching and operations, because the numbers give you nice and clean answers about the ideal course of action. But just as plotting the right course is essential for a sailor to reach the right destination, you won’t make it there without the mental resilience and support system to hold the course through any storm on the way. So in this posts we’ll talk about some of the emotional highs and lows of year 1.

If you are embarking on the search fund journey without prior small business experience, just like we did, the volatility of day-to-day operations of SMBs can surprise you. Whether you are coming from a large corporate, consulting or investing background, you’ve likely always been several layers removed from the volatility of day-to-day operations and you were dealing with a larger organization with more redundancies and back-ups.

Two employees calling out sick means you don’t have accounting, customer service or half your sales team for several days. While we obviously were aware of that reality intellectually, the emotional experience of going through those situations is a different animal. There are a lot of things that need to work out “under-the-hood” of the business just to produce the monthly financials you look at during diligence.

Talking to seasoned operators, the emotional roller coaster of the first year seems to be a rite of passage to becoming an SMB operator. With every fire you put out, the next one feels a little smaller and you stop expecting smooth sailing after every small win.

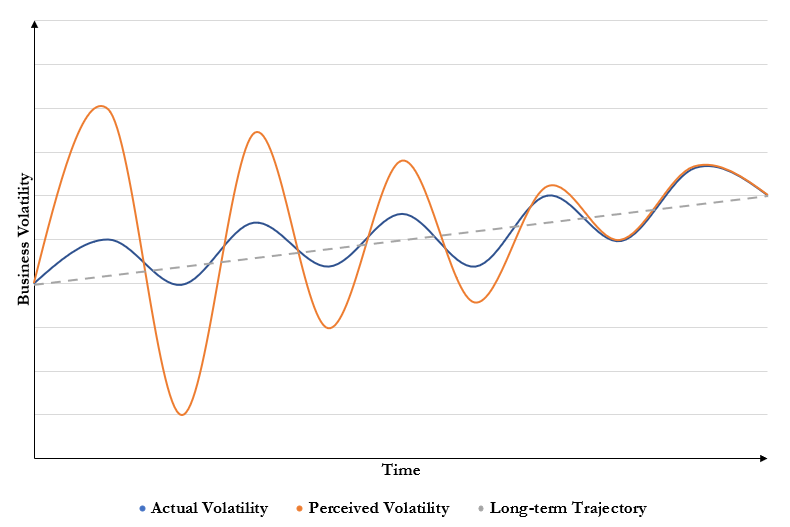

While SMBs are certainly more volatile than large companies, it’s really the perceived volatility that makes especially the first few months such a roller coaster. Without the experience from prior years and without any historical data to rely on, the ups and downs get blown out of proportion, because there is no objective telling how good / bad something is. It’s like a three year old toddler learning that a little stumble and a big fall are not equally grave - hard to figure out without prior experience / data to compare it to.

However, just like the toddler, you eventually take enough tumbles and falls so not every slow lead days feels like your product/service might be obsolete and not every good week makes you feel like you’ll take over the world.

There are two clear lessons from year one:

Start tracking important KPIs as soon as possible. Use Excel and paper if you have to, but don’t wait months to implement the perfect solution. This data is the only crutch to lean on when the first bad day / week inevitably comes.

Prepare yourself for the roller coaster by understanding that you will likely have outsized emotional reactions, building a peer group to keep you sane and structuring your deal with enough liquidity runway out the gate.

March 3rd 2022 - Damn, we might have to draw on the revolver to make our first loan payment

Whenever I experienced one of the emotional extremes of the first few months, I made a note in my phone. Looking back at them today, it is clear as day that each one of them were emotional overreactions to the small wins and setbacks of the moment. Nevertheless, they are good example of the roller coaster I am talking about.

The first note was from March 3rd 2022, 8 days after we had closed on the business. The initial meeting with the employees had gone well and we were making good progress with all the transition work. However, there was one problem. It had been below freezing since we had taken over the business and we can’t install in that weather. There were plenty of jobs in the pipeline, but every freeze day meant no installs and no money coming in, while the loan interest kept ticking up and other expenses kept accruing.

We had structured a fairly tight deal from a starting cash perspective because we knew we were buying at a seasonal working capital high, wanted to keep the total cost of the purchase low to maximize our equity and had a revolving line of credit as a backup. Having half of your first months wiped out by weather and potentially having to draw on your revolver to make your first loan payment was a pretty good reality check.

In the end, the weather turned and we did plenty of installs before the first loan payment. The seasonal working capital unwinding also helped and so we didn’t come close to drawing on the revolver then or since.

March 31st 2022 - Holy cow, this could be $100mm business!

Only 4 weeks after the first note, I created this one. We had a massive pipeline and were hiring new installers. We were going to blow last year’s numbers out of the water and we hadn’t even started marketing yet. The prior owners always told us the summer was the busiest season, so if that is what March looked like, I couldn’t even imagine June.

With this kind of demand and the growth the market had seen over the last few years, the potential for this location was orders of magnitude higher than I had thought. And if that was the case for this market, it had to be the same for our expansion markets.

There truly was a few days of gold rush feeling. Sure execution is everything, but boy the opportunity felt massive.

Again, with the benefit of hindsight, it turned out that March had always been a strong selling month. But the company did not historically track sales, only installs, so we had no comparison.

June 4th 2022 - We’re going to go bankrupt

We were off to a great start in the first few months of the business when the macro economy started shifting. Inflations numbers had started picking up, gas prices skyrocketed and the FED had started hiking interest rates. Demand hadn’t slowed down and we had a strong pipeline, but the FED had explicitly stated that they would keep hiking rates until they had destroyed enough demand (especially in services including ours) to get inflation under control.

Then the week of Memorial day rolls around and our leads dropped dramatically. Of course there was the possibility that people were just enjoying the long weekend instead of submitting turf requests, but after the spending too much time on economic news, it just felt like the FED was just going to crush us and the whole housing and home improvement industry.

I did the quick back of the envelope math and determined that with the amount of leads we got over Memorial Day week, we would not be able to pay our debt service and things were probably going to get worse as the FED kept hiking.

In reality, that week was an outlier and I hadn’t really accounted for contractor and referral leads that are harder to track but more steady. The next week leads rebounded and it turns out that making their backyard usable for their kids and pets is a pretty high priority for people, regardless of the macro economy.

Conclusion

After June 4th, there are no more entries. With every months that went by, we got more data and more experience to process the natural ups and downs of SMBs. There were still plenty of other wins and losses, but every day it gets easier to see the long-term trajectory of the business and to attribute the small ups and downs to noise.